Which of the Following Groups Is Not Among Financial Intermediaries

Answer added by Deleted user. Successful financial intermediaries have higher earnings on their investments because they are better equipped than individuals to screen out good from bad risks.

The What How And Why Of Financial Intermediaries Sciencedirect

Mutual funds are corporations that use.

. Financial intermediaries reallocate otherwise uninvested capital to productive enterprises through a. This indeed is a catch-all category. Answer A is correct.

Post comments photos and videos or broadcast a live stream to friends family followers or everyone. Mutual fund managers B. 2 and 3 only.

The most political issue in the FASBs most recent deliberations and amendments to GAAP on business combinations was. 1 2 and 3. For example if you need to borrow 1000 you could try to find an individual who wants to lend 1000.

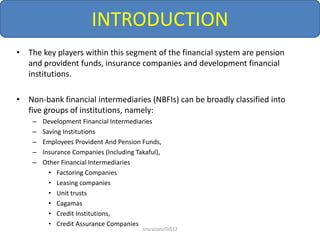

2Which entity below is a financial intermediary. Are not financial intermediaries. Grouping of financial intermediaries is not a matter of great importance for the interpretation of.

Financial intermediaries increase the efficiency of financial markets. All of these are external users of financial statements. A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction.

According to the US. A financial intermediary is an institution or individual that serves as a middleman among diverse parties in order to facilitate financial transactions. Faster than any other non-intermediary financial institution C.

Real estate investment trusts D. Kaneppeleqw and 5 more users found this answer helpful. Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges.

Which of the following groups is not among financial intermediaries. To twice its current size Weegy. A market is a group of individuals or organizations or both that need products in a given category and that have the ability willingness and authority to purchase them.

Bureau of Labor Statistics the insurance industry is expected to grow between 20 to 40 percent over the next 15 years. The institutions that are commonly referred to as financial intermediaries include commercial banks. Between 20 to 40 percent D.

A disintermediary often allows the consumer to interact directly with the producing company. A financial intermediary is a specialized firm that obtains funds from savers issues its own securities and uses the money to purchase a business s securities. A commercial bank An insurance company A pension fund A stock exchange.

Commercial business is not a financial intermediary but this includes the distribution of goods services and this include all the asset and liabilities of the business and doesnt take into account the operations. The ultimate aim of the financial intermediaries is to earn a profit and therefore they usually provide a low rate of interest on the investment made by the depositors. No similar unifying principle can be claimed for the financial intermediaries in group D.

Investment companies are frequently called mutual funds. One very important difference among the financial intermediaries in the two groups exists but it does not. An investment bank A pension fund A hardware store None of the above.

WINDOWPANE is the live-streaming social network and multi-media app for recording and sharing your amazing life. Reveal answer Formulae tables. But this would be very time consuming and you.

Which of the following groups is not among financial intermediaries. A financial intermediary offers a service to help an individual firm to save or borrow money. Which of the following groups is not among the external users for whom financial statements are prepared.

Accordingly they create new forms of capital. Which of the following is the name given to the market for intermediaries who buy finished products and sell them for a profit. Financial intermediaries which pool and manage the money of many investors are called A financial engineers B investment companies C investment bankers D credit unions Feedback.

1 and 3 only. Which one of the following is not a financial intermediary. Anything that removes the middleman intermediary in a supply chain.

A financial intermediary helps to facilitate the different needs of lenders and borrowers. Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC. As we already know that financial intermediaries operate for profits they are not charitable institutions.

1 Securitisation is the conversion of illiquid assets into marketable securities2 The reverse yield gap refers to equity yields being higher than debt yields3 Disintermediation arises where borrowers deal directly with lending individuals. Financial intermediaries can substantially reduce transaction costs per dollar of transactions because their large size allows them to take advantage of. The following are some of its disadvantages.

Low Returns on Investment. Which of the following is not a financial intermediary. Upvote 0 Downvote 0 Reply 0 Answer added by Wasi Rahman Sheikh WAREHOUSE SUPERVISOR AL MUTLAQ FURNITURE MFG.

Faster than any other financial intermediary B. Which of the following is NOT an example of a financial intermediary.

The What How And Why Of Financial Intermediaries Sciencedirect

The What How And Why Of Financial Intermediaries Sciencedirect

An Economic Account For Non Bank Financial Intermediation As An Extension Of The National Balance Sheet Accounts

Comments

Post a Comment